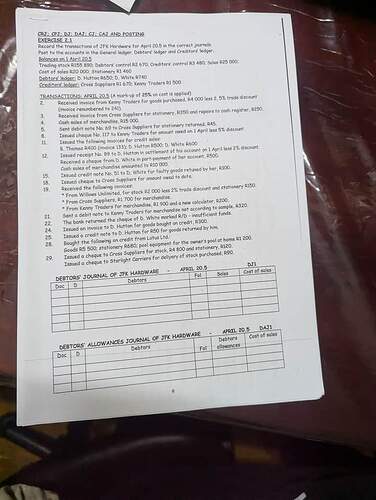

It looks like you’ve uploaded a worksheet related to Account Ledgers and the exercise includes tasks for recording transactions into various journals (e.g., Debtors’ Journal, Debtors’ Allowances Journal, and posting to the corresponding ledgers such as General Ledger, Debtors’ Ledger, and Creditors’ Ledger). Let’s analyze and solve this step by step.

Understanding the Worksheet

-

Balances (on April 1, 20.5):

These represent opening balances like:- Trading Stock

- Debtors’ Control

- Creditors’ Control

- Cost of Sales

- Stationery expenses, etc.

-

Transactions for April 20.5:

Each listed transaction involves recording in journals such as:- Debtors’ Journal (DJ): For sales made to debtors (on credit).

- Debtors’ Allowances Journal (DAJ): For returns/allowances given to customers.

- Creditors’ Journal (CJ): For purchases or expenses incurred, payable to creditors.

- Creditors’ Allowance Journal (CAJ): For returns, discounts, or reductions from creditors.

- Cash Journal (CRJ & CPJ): For cash receipts & payments, respectively.

Step-by-Step Solution

We will record each transaction under its relevant heading and post to the correct journals and corresponding ledgers.

Transactions Breakdown

Transaction 1:

- Received invoice from Kenny Traders for goods purchased R4,000, less 2.5% trade discount.

- Kenny Traders is a creditor.

- Trade Discount Calculation: 4000 \times 2.5\% = 100

- Net Amount Payable: 4000 - 100 = R3900

- Journal: Record in Creditors’ Journal (CJ).

Transaction 2:

- Received payment from Cross Suppliers for stationery R350 and repair for cash register R250.

- Cash Payment: Recorded in Cash Payments Journal (CPJ).

- Split into relevant accounts (Stationery expense: R350, Repair expense: R250).

Transaction 3:

- Cash sales of goods, R185.

- Record in the Cash Receipts Journal (CRJ) under Sales.

Transaction 4:

- Issued debit note to Cross Suppliers for stationery returned R45.

- Record in Creditors’ Allowance Journal (CAJ).

Transaction 5:

- Sent invoice to D. White for goods sold on credit R600.

- Record in Debtors’ Journal (DJ).

- Post to Debtors Ledger (D. White).

Transaction 6:

- Received payment from D. Hutton R650; on April 1, less 2% discount.

- Discount Calculation: 650 \times 2\% = R13

- Net Payment Received: 650 - R13 = R637

- Journal: Record in Cash Receipts Journal (CRJ) for Debtor payment and discount.

Transaction 7:

- Issued debit note to D. White for faulty goods returned by her, R100.

- Record in Debtors’ Allowances Journal (DAJ).

Transaction 11:

- Bought goods from Cross Suppliers: R860.

- Record in Creditors’ Journal (CJ) for purchase of trading stock.

Transaction 12:

- Sent invoice to D. Hutton for goods sold on credit R150.

- Record in Debtors’ Journal (DJ).

Transaction 23:

- Bought from Lotus Ltd. on credit: pool equipment R680.

- Record in Creditors’ Journal (CJ).

Posting to Journals

Below is an example of how entries will appear in the Debtors’ Journal and Debtors’ Allowances Journal:

Debtors’ Journal of JFK Hardware | April 20.5

| Doc | Debtors | Fol | Sales | Cost of Sales |

|---|---|---|---|---|

| Inv-01 | D. White | DJ1 | R600 | [Calculate as per markup] |

| Inv-02 | D. Hutton | DJ2 | R150 | [Calculate as per markup] |

Debtors’ Allowances Journal of JFK Hardware | April 20.5

| Doc | Debtors | Fol | Debtors Allowance | Cost of Sales |

|---|---|---|---|---|

| DA-01 | D. White | DAJ1 | R100 | [Calculate] |

Similarly, create entries for Creditors’ Journal, Creditors’ Allowances Journal, Cash Receipts Journal, and Cash Payments Journal.

Once journals are populated, post transactions to the respective General Ledger, Debtors Ledger, and Creditors Ledger accounts.

General Journal Postings

Each journal created above will be posted into the General Ledger (accounts like Trading Stock, Stationery Expense, Sales, Debtors’ Control, Creditors’ Control, etc.) and the subsidiary ledgers.

Let me know if you’d like an example of the ledger postings for specific transactions! ![]()