I’m unable to access or interpret images directly. However, I can help explain the concept of liquidating partnerships and capital deficiencies.

Liquidating Partnerships and Capital Deficiency

1. Understanding Liquidation

Liquidating a partnership involves settling its obligations and distributing any remaining assets to the partners. This process occurs when a partnership dissolves and must wind up its affairs. Key steps in liquidation include:

- Selling off Assets: Converting non-liquid assets into cash.

- Paying Liabilities: Satisfying obligations to creditors before distributing remaining cash to partners.

- Distributing Remaining Cash: After liabilities are paid, remaining cash is distributed to partners according to their capital account balances.

2. Capital Accounts in Liquidation

Each partner’s capital account represents their share of the partnership’s net assets. When liquidating:

- Capital Accounts Updated Post-Realization: Adjustments are made for profits or losses from liquidating assets.

- Deficiency Occurs: If a partner’s account is negative (i.e., they owe more than they are entitled to), it’s termed a capital deficiency.

3. Capital Deficiency

A capital deficiency arises when a partner’s capital account has a debit balance after liabilities are settled:

- Personal Obligation: Partner with a deficiency is usually responsible for restoring it.

- Bankruptcy or Inability to Pay: Other partners may cover the deficiency according to their profit-sharing ratios.

Example Scenario

Let’s consider the scenario described where partners have specific capital balances:

-

Balances Before Liquidation:

- Nettles: $60,000 Dr (debit)

- King: $120,000 Cr (credit)

- Tanaka: $113,000 Cr (credit)

-

Nettles’ Bankrupt Status: Nettles cannot pay their $60,000 deficiency.

4. Addressing Capital Deficiency:

If a partner like Nettles cannot cover their deficiency due to bankruptcy:

- Deficiency Absorbed by Other Partners: The remaining partners, King and Tanaka, will absorb the deficiency according to their profit or loss sharing ratios.

- Adjusting Remaining Capital Balances: Update the balances in King’s and Tanaka’s accounts accordingly.

5. Calculation Example:

Assuming King and Tanaka share profits 1:1:

- Nettles’ inability to pay $60,000:

- $30,000 absorbed by King

- $30,000 absorbed by Tanaka

After adjustments:

- King’s Final Balance: $120,000 - $30,000 = $90,000

- Tanaka’s Final Balance: $113,000 - $30,000 = $83,000

These final balances represent the amount King and Tanaka receive upon liquidation.

Understanding this framework helps manage liquidation scenarios effectively, ensuring a fair and legal dissolution of partnership affairs.

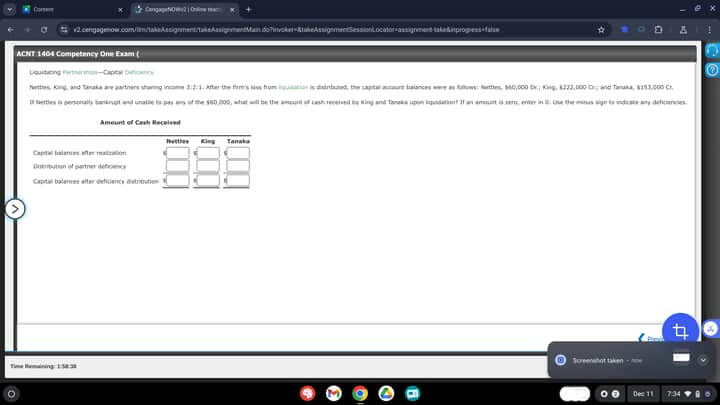

Liquidating Partnerships-Capital Deficiency

Nettles

, King, and Tanaka are partners sharing income 3:2:1. After the firm’s loss from liquidation is distributed, the capital account balances were as follows: Nettles, $60,000 Dr.; King, $222,000 Cr.; and Tanaka, $153,000 Cr.

If Nettles is personally bankrupt and unable to pay any of the 60,000, what will be the amount of cash received by King and Tanaka upon liquidation? If an amount is zero, enter in 0. Use the minus sign to indicate any deficiencies.

Amount of Cash Received

Nettles

King

Tanaka

$

Capital balances after realization

Distribution of partner deficiency

Capital balances after deficiency distribution

To solve this problem, we need to allocate Nettles’ deficiency among the remaining partners, King and Tanaka, based on their profit-sharing ratio of 3:2:1. In this situation, King and Tanaka will absorb the deficiency because Nettles is unable to pay.

Steps to Resolve Capital Deficiency

1. Net Capital Balance Calculation

Given capital balances after the loss from liquidation:

- Nettles: $60,000 Dr (deficiency)

- King: $222,000 Cr

- Tanaka: $153,000 Cr

2. Profit-Sharing Ratios

The partners share profits and losses in the ratio of 3:2:1, which means:

- Total parts = 3 + 2 + 1 = 6

- King’s share = 2 parts

- Tanaka’s share = 1 part

3. Distributing Nettles’ Deficiency

Nettles’ deficiency is $60,000. We’ll distribute it to King and Tanaka according to their ratio (2:1).

- King’s share of deficiency: ((2/3) \times $60,000 = $40,000)

- Tanaka’s share of deficiency: ((1/3) \times $60,000 = $20,000)

4. Adjusted Capital Balances After Deficiency Distribution

-

King’s Adjusted Balance:

[

222,000 - 40,000 = 182,000

] -

Tanaka’s Adjusted Balance:

[

153,000 - 20,000 = 133,000

]

Final Cash Received by Each Partner

- King receives: $182,000

- Tanaka receives: $133,000

By resolving the deficiency, the remaining partners absorb losses proportionally, ensuring equitable distribution upon liquidation.